By PETER ROSENTHAL, President

V.I.P. Trust Deed Company

Almost everybody reading this article are either making payments on real estate loans or, perhaps, receiving payments on real estate loans. If you’re making payments on real estate loans you’re probably sending the payment in every month and getting a receipt showing monthly interest and principal figures or, at least an annual statement showing amounts paid to interest, principal and unpaid principal balance. If you’re paying to a conventional lender, most people “ASSUME” that the lender’s figures are accurate. With a conventional lender the figures USUALLY are accurate unless there has been a change in the servicing company or, perhaps mistakes in computing adjustable rates. If you’re paying loans to a private party the calculations of interest, principal and remaining balances are much more likely to be imperfect. Even if the private party loan is being collected by a bank or servicing company, the figures can easily be defective.

Years ago I looked into a payoff of a private party loan for a client of ours and discovered a discrepancy in the approximate amount of $5,000. The lender had an official looking spread- sheet. We ran the figures for the customer and, “voila” a big discrepancy.

Figuring the interest and pay down on a monthly payment is easy. You do not have to trust the lender’s figures. Any real estate professional can furnish you with an amortization schedule that will show you the breakdown for the life of your loan. On the other hand, you can easily double-check a lender’s figures.

In the situation I described above, the lender was figuring the interest DAILY rather than monthly. Most California mortgage payments are figured on a MONTHLY basis. Banks sometimes use a daily interest calculation.

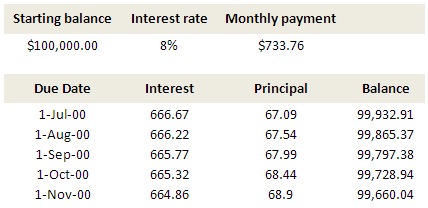

On the assumption that your payment is figured on a monthly basis, the calculations are fairly simple. Every month you figure the interest based on the money you still owe from the previous month. Therefore, lets assume that you borrow $100,000.00 at 8% interest on the first of June with a monthly payment of $733.76 (30 years). On July 1 your payment is due which pays interest FROM June 1st to July 1st. The calculations go like this: $100,000.00 times 8% equals $8,000.00, i.e. one year’s interest. Divide that by twelve to arrive at one month’s interest ($666.67). Since the monthly payment was $733.76 and the interest charge was $666.67, the difference ($67.09) is the amount of principal reduction for that month. The remaining principal balance after the first month payment would be $100,000.00 minus $67.09, equals $99,932.91.

Figuring the second payment would be exactly the same way, i.e. $99,932.91 times 8% equals $7,994.63 (one year interest), divided by twelve, equals $666.22 (one month’s interest). Subtract this from the monthly payment of $773.76 to get a principal reduction of $67.54 (second month). The remaining principal balance after the second payment would be $99,865.37. The first five payments would look like this:

There really is no mystery to your monthly payments as long as you can do a little simple multiplication and subtraction.

Now that you can figure this “mysterious amortization”, let me suggest the wonders of OVERPAYMENT. Based on the assumption that you will be keeping the property for more than a few years, and on the further assumption that the interest rate is more than 7-8%, I always recommend an overpayment either monthly or once in a while. If you overpay your mortgage payment, the overpayment will be applied to the principal balance. Since interest is charged monthly, the next month’s interest will be charged on the smaller balance. As I have stated in a previous column, the BI-MONTHLY mortgage plan is nothing other than having to pay one extra payment a year. I am certain that most of my readers understand this now. In the above example you might want to pay $800 every month, or $850 if the budget allows. If you can’t pay extra every month, merely overpay a lump sum (with your regular payment) when you get your tax refund or “whenever”.

Hopefully this article will have taken some of the mystery out of the amortization process. This should allow you to double-check your lender once in a while. Double checking your lender’s figures is very, very important if you’re paying a private beneficiary who figures these payments by hand. In my opinion, anybody making mortgage payments should have an amortization schedule so that they can compare the lender’s figures to the amortization schedule.

A further word about bi-monthly mortgage payment plans. If you have not read my previous column on the subject and/or don’t understand that a bi-monthly plan equals the equivalent of thirteen ACTUAL payments in a twelve-month period, you may send me a self-addressed, stamped envelope marked “bi-monthly mortgage” and I will be happy to send you the “V.I.P. method” of accomplishing the same results, with no $400 setup fee.

Peter Rosenthal

VIP Trust Deed Company